11 พ.ย. 2566พุซซี่888 สมัครพุซซี่888พุซซี่888 ดาวน์โหลด ฟรี true wallet100% สล็อต ขั้นต่ำ 1 บาท Top 78 by Lino แจกเครดิตฟรี

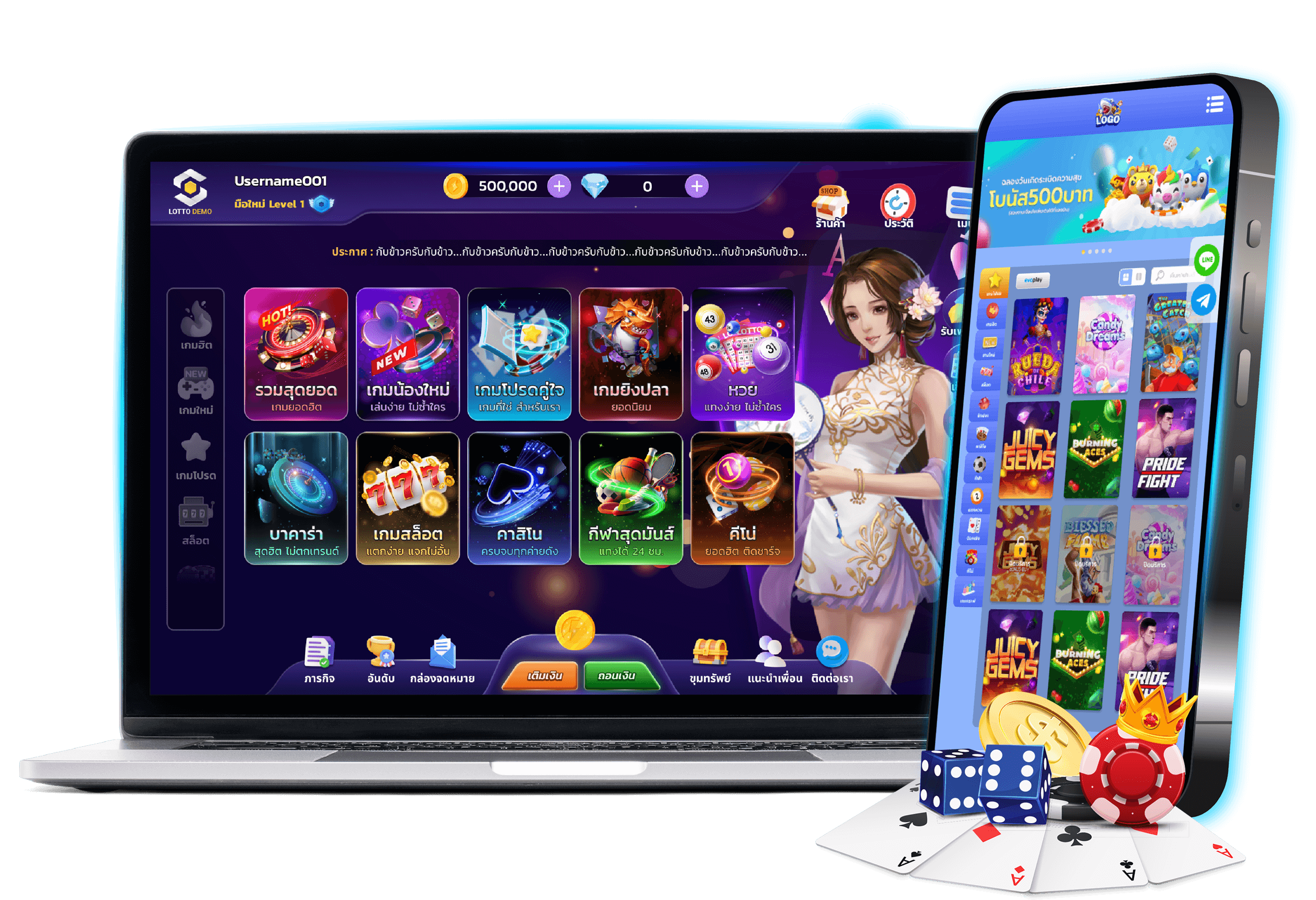

Pussy888 พุซซี่888 เว็บไซต์สล็อตออนไลน์ บริการเกมสล็อตออนไลน์ที่เหมาะสมที่สุด

Pussy888 พุซซี่888 เว็บไซต์สล็อตออนไลน์ บริการเกมสล็อตออนไลน์ที่เหมาะสมที่สุด

Pussy888 เป็นเกมสล็อตออนไลน์ยอดนิยมในโลกของการเดิมพันออนไลน์ มีชื่อเสียงในฐานะหนึ่งในเกมสล็อตออนไลน์มากมายก่ายกอง ที่เสนอโดยคาสิโนออนไลน์และแพลตฟอร์มเกมต่างๆโดยปกติเกมจำพวกนี้จะมีธีม กราฟิก รวมทั้งแบบการเล่นที่วางแบบมาเพื่อเย้ายวนใจผู้เล่นที่มองหาความสนุกสนานแล้วก็ความน่าจะเป็นที่จะชนะรางวัล เป็นเกมสล็อตออนไลน์ที่ได้รับความนิยมในหลายประเทศในเอเชียตะวันออกเฉียงใต้รวมถึงเมืองไทยด้วย ได้รับการตำหนิดตามเนื่องมาจากรูปแบบการเล่นที่น่าดึงดูด กราฟิกที่น่าดึงดูด และก็สมรรถนะที่ผู้เล่นจะได้รับเงินจริง

ความนิยมของเกมสล็อตค่ายดัง จากบริการ พุซซี่888 สล็อต ในประเทศไทย

การเดิมพันออนไลน์รวมถึงเกมสล็อตอย่าง พุซซี่888 pussy888 นับว่าเป็นความเบิกบานใจแบบอย่างหนึ่งที่ได้รับความนิยมในประเทศไทย ผู้เล่นคนประเทศไทยเยอะแยะสนุกสนานกับการเล่นเกมเหล่านี้บนแพลตฟอร์มการพนันออนไลน์ต่างๆความนิยมของเรา ในประเทศไทยบางทีอาจได้รับอิทธิพลจากหลายเหตุ การเข้าถึงเกมสล็อตออนไลน์สามารถเข้าถึงได้ง่ายสำหรับทุกคนที่มีการเชื่อมต่ออินเทอร์เน็ตและก็เครื่องไม้เครื่องมือที่รองรับ การเข้าถึงนี้มีส่วนทำให้เป็นที่นิยม

เกมสล็อตออนไลน์ pussy888 มาพร้อมต้นแบบการเล่นที่รื้นเริง

เกมสล็อตออนไลน์มีธีม คุณสมบัติ และรอบโบนัสที่หลากหลาย ซึ่งทำให้การเล่นเกมน่าดึงดูดแล้วก็ครึกครื้น มาพร้อมกับอัตราการชนะที่เป็นไปได้ ผู้เล่นถูกดึงดูดให้เล่นเกมสล็อตออนไลน์เพราะพวกเขาได้โอกาสที่จะชนะเงินใช่หรือรางวัลอื่นๆรวมไปถึงในเรื่องของโปรโมชั่นแล้วก็โบนัสเราเป็นอีกหนึ่งแพลตฟอร์มเกมที่พร้อมมอบโปรโมชั่นแล้วก็โบนัสเพื่อดึงดูดแล้วก็รักษาผู้เล่น ทำให้เกมน่าดึงดูดเพิ่มขึ้น ผู้เล่นบางบุคคลเพลินกับประเด็นด้านสังคมของเกมสล็อตออนไลน์ รวมทั้งการคุยกันกับผู้เล่นคนอื่นในเวลาที่เล่น

สล็อต ค่ายดังแบ่งปันวิธีการได้กำไรจากเกมสล็อตออนไลน์ pussy888

การเล่นสล็อตออนไลน์โดยมีเป้าหมายในการทำกำไรนั้นเกิดเรื่องที่ท้าทายเพราะเหตุว่าเกมเหล่านี้ขึ้นอยู่กับโชคเป็นหลักรวมทั้งเจ้ามือย่อมได้เปรียบเสมอ แต่ ถ้าเกิดคุณสนุกกับการเล่นสล็อตออนไลน์และปรารถนาเพิ่มโอกาสสำหรับการชนะหรือขั้นต่ำก็ขยายเวลาการเล่นของคุณ นี่เป็นเทคนิคบางประการที่ควรพิเคราะห์ ดังต่อไปนี้

1. เลือกสล็อต pussy888 RTP สูง มองหาเกมสล็อตที่มีเปอร์เซ็นต์ผลตอบแทนต่อผู้เล่น (RTP) สูง RTP ระบุเปอร์เซ็นต์เฉลี่ยของเงินเดิมพันที่สล็อตแมชชีนจะคืนให้กับผู้เล่นเมื่อเวลาผ่านไป สล็อต RTP ที่สูงกว่าในทางแนวความคิดจะให้อัตราต่อรองที่ดียิ่งกว่า

2.กำหนดงบประมาณ ก่อนที่จะคุณจะเริ่มเล่น ให้ตั้งงบประมาณสำหรับตัวคุณเอง ตกลงใจว่าคุณยินดีจ่ายเยอะแค่ไหนและตั้งมั่นในสิ่งนั้น อย่าพนันด้วยเงินที่คุณไม่สามารถสูญเสียได้

3.ใช้โหมดเล่นฟรีหรือโหมดแสดง คาสิโนออนไลน์ พุซซี่888 หลายที่เสนอโหมดเล่นฟรีหรือโหมดสาธิตสำหรับเกมสล็อตของตนเอง ใช้สิ่งเหล่านี้เพื่อฝึกฝนและก็ทำความเข้าใจกลไกของเกมก่อนเล่นด้วยเงินจริง

4. พนันอย่างชาญฉลาด หลบหลีกการวางเดิมพันสูงสุดในทุกการหมุน ให้ลองเดิมพันน้อยลงเพื่อเงินลงทุนของคุณคงอยู่นานขึ้น การเดิมพันที่น้อยกว่าสามารถลดความเสี่ยงของการสูญเสียที่สำคัญได้

5. จัดแบ่งงบประมาณ แบ่งงบประมาณของคุณออกเป็นช่วงๆรวมทั้งควบคุมจำนวนเงินที่คุณเดิมพันต่อการหมุน ดังเช่นว่า หากคุณมีงบประมาณ 500 สำหรับวันนั้น คุณอาจตกลงใจพนัน 5 บาท ต่อเซสชัน รวมทั้งสิ้นสิบเซสชัน

6. เล่นเพื่อความสนุกสนาน เพลินกับสล็อตออนไลน์ในรูปแบบของความสนุกสนานแทนที่จะเป็นวิถีทางสำหรับในการสร้างรายได้ ไม่รับประกันชัยชนะ และก็การแพ้ก็เป็นได้

7. รู้ดีว่าเมื่อใดควรจะเลิก ถ้าหากคุณกำลังแพ้สม่ำเสมอหรือมีงบประมาณถึงเกณฑ์แล้ว จำต้องทราบว่าเมื่อใดควรจะเลิก การไล่หลังการสิ้นไปบางทีอาจก่อให้เกิดการสูญเสียที่สำคัญยิ่งขึ้นไปอีก

8.ใช้ประโยชน์จากโบนัส คาสิโนออนไลน์บางพื้นที่เสนอโบนัสแล้วก็โปรโมชั่น ดังเช่นว่า ฟรีสปินหรือการประลองการฝากเงิน สิ่งพวกนี้สามารถยืดเวลาการเล่นของคุณรวมทั้งมอบโอกาสสำหรับเพื่อการชนะโดยไม่มีความเสี่ยงเพิ่มเติมอีก

9. ทำความเข้าใจเกม เกมสล็อต สล็อต พุซซี่888 แต่ละเกมมีเอกลักษณ์เฉพาะตัว โดยมีกฎข้อปฏิบัติ ตารางการชำระเงิน รวมทั้งฟีเจอร์ของตนเอง ใช้เวลาทำความเข้าใจว่าเกมที่คุณกำลังเล่นทำงานยังไง

10.การสุ่มเดาและโชค โปรดจำไว้เสมอว่าสล็อตออนไลน์นั้นขึ้นอยู่กับตัวสร้างฐานะเลขสุ่ม (RNG) แล้วก็การหมุนแต่ละครั้งจะไม่ขึ้นอยู่กับการหมุนครั้งที่แล้ว โชคมีบทบาทสำคัญ และไม่มีวิธีการใดที่จะค้ำประกันกำไรได้

11.แจ็คพอตแบบโปรเกรสซีฟ ถ้าคุณยินดีที่จะรับความเสี่ยงที่สำคัญกว่านี้ ทดลองตรึกตรองเล่นสล็อต พุซซี่888 แจ็คพอตแบบโปรเกรสซีฟ สิ่งเหล่านี้เสนอโอกาสในการได้รับเงินโตที่เปลี่ยนชีวิตได้ แต่ว่าก็มีความผันผวนสูงขึ้นมากยิ่งกว่าด้วยเหมือนกัน

การลงพนันเกมสลอดออนไลน์ พุซซี่888 ผ่านเว็บแห่งนี้นับว่าเป็นอีกหนึ่งรูปแบบ วิถีทางแนวทางการทำเงิน พี่พร้อมจะแจกโบนัสและเคล็ดวิธี เพื่อสร้างรายได้ให้กับนักพนัน ที่ไม่ว่าคุณจะเป็นมือใหม่หรือมืออาชีพ ทางเว็บไซต์ของพวกเราก็มีทางลัด เพื่อช่วยทำให้คุณได้รับเงินรางวัลอย่างราบรื่น ด้วยเหตุดังกล่าวการลงทะเบียนเป็นสมาชิกเข้ามาใช้บริการ จะยิ่งช่วยให้นักเดิมพันสามารถรับโปรโมชั่นแล้วก็ สิทธิประโยชน์เพื่อประหยัดเงินทุน กับการผลิตรายได้ด้วยเกมสล็อตออนไลน์จากค่ายดังแห่งนี้ ไม่ว่าคุณจะใช้งานผ่านระบบใด ก็สามารถเพื่อเพลิดเพลินไปกับเกมสล็อตออนไลน์ ผ่านระบบที่มีมาตรฐานระดับสากล ตัวเลือกในการทำเงินสำหรับคนยุคใหม่

การลงพนันเกมสลอดออนไลน์ พุซซี่888 ผ่านเว็บแห่งนี้นับว่าเป็นอีกหนึ่งรูปแบบ วิถีทางแนวทางการทำเงิน พี่พร้อมจะแจกโบนัสและเคล็ดวิธี เพื่อสร้างรายได้ให้กับนักพนัน ที่ไม่ว่าคุณจะเป็นมือใหม่หรือมืออาชีพ ทางเว็บไซต์ของพวกเราก็มีทางลัด เพื่อช่วยทำให้คุณได้รับเงินรางวัลอย่างราบรื่น ด้วยเหตุดังกล่าวการลงทะเบียนเป็นสมาชิกเข้ามาใช้บริการ จะยิ่งช่วยให้นักเดิมพันสามารถรับโปรโมชั่นแล้วก็ สิทธิประโยชน์เพื่อประหยัดเงินทุน กับการผลิตรายได้ด้วยเกมสล็อตออนไลน์จากค่ายดังแห่งนี้ ไม่ว่าคุณจะใช้งานผ่านระบบใด ก็สามารถเพื่อเพลิดเพลินไปกับเกมสล็อตออนไลน์ ผ่านระบบที่มีมาตรฐานระดับสากล ตัวเลือกในการทำเงินสำหรับคนยุคใหม่

เว็บสล็อต ทั้งหมด พุซซี่888 มีให้เลือกกว่า 200 เกม 26 October 2023 Lino โอนเงินสด สล็อตให้เยอะที่สุด Top 84

เว็บสล็อต ทั้งหมด พุซซี่888 มีให้เลือกกว่า 200 เกม 26 October 2023 Lino โอนเงินสด สล็อตให้เยอะที่สุด Top 84

ขอขอบคุณreference pussy888

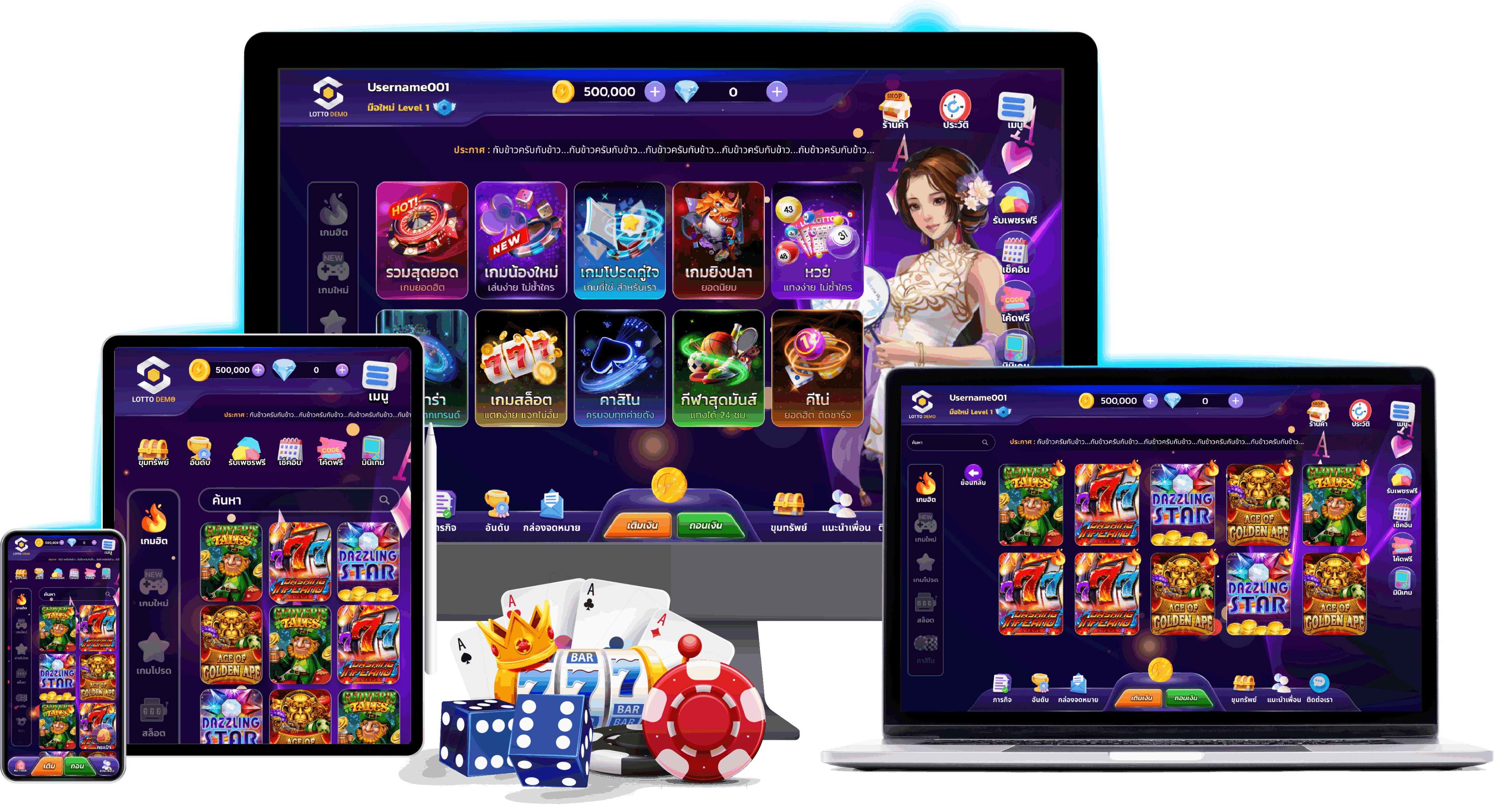

ในปัจจุบัน มีเว็บไซต์พนันบอลออนไลน์เปิดใหม่เยอะมากมายก่ายกอง แต่ผมบอกเลยนะครับว่า ไม่มีเว็บไหนร้อนแรงไปกว่าufabet ของเราแล้วล่ะครับผม พวกเราเป็นเว็บไซต์พนันบอลออนไลน์เปิดใหม่ที่มาแรงสุดๆเว็บไซต์น้องใหม่ที่เป็นเว็บไซต์ตรง ขึ้นตรงกับบริษัทแม่ในต่างชาติ มีความน่านับถือรวมทั้งความปลอดภัยสูง โปรโมชั่นดีๆมาแบบจัดเต็ม ระบบออโต้ตั้งแต่การสมัคร การฝาก หรือการถอน ช่วยทำให้คุณสามารถทำรายการต่างๆด้วยตัวเองได้เลย ผ่านแอดมินน้อยมากๆเรียกว่า ลดข้อผิดพลาดและเพิ่มความปลอดภัยได้แบบสุดๆยิ่งไปกว่านี้ คุณจะได้รับค่าน้ำประปาหรือราคาที่เป็นกลาง สามารถเข้ามาแทงได้ง่าย ไม่ยุ่งยากแน่นอน ใครกันแน่พอใจลงทะเบียนเป็นสมาชิกก็มาเลยนะครับ เรายินดีต้อนรับ สมัครสมาชิกได้เลยที่นี่!

ในปัจจุบัน มีเว็บไซต์พนันบอลออนไลน์เปิดใหม่เยอะมากมายก่ายกอง แต่ผมบอกเลยนะครับว่า ไม่มีเว็บไหนร้อนแรงไปกว่าufabet ของเราแล้วล่ะครับผม พวกเราเป็นเว็บไซต์พนันบอลออนไลน์เปิดใหม่ที่มาแรงสุดๆเว็บไซต์น้องใหม่ที่เป็นเว็บไซต์ตรง ขึ้นตรงกับบริษัทแม่ในต่างชาติ มีความน่านับถือรวมทั้งความปลอดภัยสูง โปรโมชั่นดีๆมาแบบจัดเต็ม ระบบออโต้ตั้งแต่การสมัคร การฝาก หรือการถอน ช่วยทำให้คุณสามารถทำรายการต่างๆด้วยตัวเองได้เลย ผ่านแอดมินน้อยมากๆเรียกว่า ลดข้อผิดพลาดและเพิ่มความปลอดภัยได้แบบสุดๆยิ่งไปกว่านี้ คุณจะได้รับค่าน้ำประปาหรือราคาที่เป็นกลาง สามารถเข้ามาแทงได้ง่าย ไม่ยุ่งยากแน่นอน ใครกันแน่พอใจลงทะเบียนเป็นสมาชิกก็มาเลยนะครับ เรายินดีต้อนรับ สมัครสมาชิกได้เลยที่นี่!

สวัสดีขอรับชาว 918VIP ทุกท่าน เซฟปากทางเข้า 918kiss เข้าสู่ระบบ กันรึยังขอรับ? ตอนนี้ทางค่ายอินเตอร์เน็ตหลายๆค่าย ไม่ว่า

สวัสดีขอรับชาว 918VIP ทุกท่าน เซฟปากทางเข้า 918kiss เข้าสู่ระบบ กันรึยังขอรับ? ตอนนี้ทางค่ายอินเตอร์เน็ตหลายๆค่าย ไม่ว่า 1. โปรโมชั่น เชิญชวนเพื่อนฝูงฝาก 100

1. โปรโมชั่น เชิญชวนเพื่อนฝูงฝาก 100

บาคาร่าออนไลน์เว็บไหนดี sexy บาคาร่า www.sexybaccarat168.com 23 กันยายน 2565 เว็บไซต์เด็ด เว็บดัง ปังวัวรตๆมาตรงนี้ร่ำรวยแน่แค่เล่นบาคาร่า

บาคาร่าออนไลน์เว็บไหนดี sexy บาคาร่า www.sexybaccarat168.com 23 กันยายน 2565 เว็บไซต์เด็ด เว็บดัง ปังวัวรตๆมาตรงนี้ร่ำรวยแน่แค่เล่นบาคาร่า การตลาดออนไลน์ สมัครบาคาร่า สำคัญๆที่นิยมทำกัน ก็คือ เฟส Ads,

การตลาดออนไลน์ สมัครบาคาร่า สำคัญๆที่นิยมทำกัน ก็คือ เฟส Ads,  Slotxo บริการสล็อตออนไลน์ที่เปิดให้ใช้งานด้วยความมั่นคงมาอย่างนาน โดยเกมสล็อตออนไลน์ที่มีบนเว็บนี้เป็นเกมสล็อตออนไลน์ที่เป็นที่รู้จัก พร้อมด้วยเป็นเกมสล็อตออนไลน์ที่ช่วยสร้างกำไรให้กับสมาชิกได้อย่างดีเยี่ยม ผู้ที่กำลังมองหาเกมการพนันสล็อตออนไลน์ทำเงินสร้างรายได้ เราขอแนะนำให้ท่านได้ทราบจะกับเกมสล็อตออนไลน์ผ่านทางเว็บไซต์ของเรา โดยเกมสล็อตออนไลน์ที่เรามีให้บริการผ่านทางเว็บแห่งนี้ เป็นเกมสล็อตออนไลน์ที่มีความยั่งยืนมั่นคงในการเปิดให้ใช้งานอย่างยิ่ง นักพนันสามารถรับชมเกมการเดิมพันสล็อตออนไลน์ที่มีบนเว็บไซต์แห่งนี้ เพื่อสร้างกำไรแล้วก็เป็นวิถีทางการหารายได้อีกหนึ่งต้นแบบ โดยเกมสล็อตออนไลน์บนเว็บของพวกเรา เป็นเกมสุดคลาสสิกระดับตำนานที่พวกเราเอามาให้คุณได้ใช้บริการอย่างจัดหนักจัดเต็ม ผ่านทางเว็บไซต์ของพวกเราเพื่อโอกาสในการทำเงินสร้างรายได้ที่ยอดเยี่ยม

Slotxo บริการสล็อตออนไลน์ที่เปิดให้ใช้งานด้วยความมั่นคงมาอย่างนาน โดยเกมสล็อตออนไลน์ที่มีบนเว็บนี้เป็นเกมสล็อตออนไลน์ที่เป็นที่รู้จัก พร้อมด้วยเป็นเกมสล็อตออนไลน์ที่ช่วยสร้างกำไรให้กับสมาชิกได้อย่างดีเยี่ยม ผู้ที่กำลังมองหาเกมการพนันสล็อตออนไลน์ทำเงินสร้างรายได้ เราขอแนะนำให้ท่านได้ทราบจะกับเกมสล็อตออนไลน์ผ่านทางเว็บไซต์ของเรา โดยเกมสล็อตออนไลน์ที่เรามีให้บริการผ่านทางเว็บแห่งนี้ เป็นเกมสล็อตออนไลน์ที่มีความยั่งยืนมั่นคงในการเปิดให้ใช้งานอย่างยิ่ง นักพนันสามารถรับชมเกมการเดิมพันสล็อตออนไลน์ที่มีบนเว็บไซต์แห่งนี้ เพื่อสร้างกำไรแล้วก็เป็นวิถีทางการหารายได้อีกหนึ่งต้นแบบ โดยเกมสล็อตออนไลน์บนเว็บของพวกเรา เป็นเกมสุดคลาสสิกระดับตำนานที่พวกเราเอามาให้คุณได้ใช้บริการอย่างจัดหนักจัดเต็ม ผ่านทางเว็บไซต์ของพวกเราเพื่อโอกาสในการทำเงินสร้างรายได้ที่ยอดเยี่ยม

ขอขอบคุณby

ขอขอบคุณby

เริ่มเล่นบาคาร่า ทีแรกก็ช่วยคุณได้แน่ๆ เชื่อสิคุ้มค่ามากมายๆ

เริ่มเล่นบาคาร่า ทีแรกก็ช่วยคุณได้แน่ๆ เชื่อสิคุ้มค่ามากมายๆ แม้ใครต้องการจะทดลองเล่นแอปฯ สมัครบาคาร่า ที่ต่างกันของแต่ละคน บางคนอยากจจะเล่น เพื่อเอาความสนุกสนานร่าเริง บรรเทาสมองที่เหนื่อยล้า จากการทำงานมาทั้งวัน หรือบางคนเล่นเพื่อเอาเงินรางวัลจากมัน ไปใช้จ่ายในชีวิตประจำวัน แม้กระนั้นไม่ว่าจะเหตุผลอะไรก็ตามมแต่ ขั้นตอนฐานรากเราจำเป็นจะต้องรู้ไว้และกระทำตามด้วยเหมือนกันหมดเป็นหาเว็บ สมัคร sexyauto168.com ได้เลย

แม้ใครต้องการจะทดลองเล่นแอปฯ สมัครบาคาร่า ที่ต่างกันของแต่ละคน บางคนอยากจจะเล่น เพื่อเอาความสนุกสนานร่าเริง บรรเทาสมองที่เหนื่อยล้า จากการทำงานมาทั้งวัน หรือบางคนเล่นเพื่อเอาเงินรางวัลจากมัน ไปใช้จ่ายในชีวิตประจำวัน แม้กระนั้นไม่ว่าจะเหตุผลอะไรก็ตามมแต่ ขั้นตอนฐานรากเราจำเป็นจะต้องรู้ไว้และกระทำตามด้วยเหมือนกันหมดเป็นหาเว็บ สมัคร sexyauto168.com ได้เลย เว็บไซต์เว็บบาคาร่าที่ดีแน่ๆ ไม่ควรละเลย

เว็บไซต์เว็บบาคาร่าที่ดีแน่ๆ ไม่ควรละเลย พวกเราจะเล่น บาคาร่าออนไลน์ เพื่อความสนุกสนานร่าเริงหรือเครียดน้อยลง แต่ที่จริงแล้วมันสามารถให้มากกว่าความเพลิดเพลินก็คือ เงินรางวัลนั่นเอง เนื่องด้วยเกมสล็อตก็คือเกมคาสิโนออนไลน์ ถ้าผู้ใดต้องการจะเล่น ก็จำต้องเพิ่มเงินปริมาณหนึ่งเพื่อเข้าไปเล่นได้ แค่เพียงเราจะใช้เงินน้อยมากกว่าการไปเล่นถึงบ่อนต่างชาติ เพราะด้วยระบบออนไลน์ที่ย้ำการเข้าถึงคนทุกชนชั้น ไมม่ว่าเราจะมีเงินแค่เพียงบาทเดียว เราก็สามารถเล่น

พวกเราจะเล่น บาคาร่าออนไลน์ เพื่อความสนุกสนานร่าเริงหรือเครียดน้อยลง แต่ที่จริงแล้วมันสามารถให้มากกว่าความเพลิดเพลินก็คือ เงินรางวัลนั่นเอง เนื่องด้วยเกมสล็อตก็คือเกมคาสิโนออนไลน์ ถ้าผู้ใดต้องการจะเล่น ก็จำต้องเพิ่มเงินปริมาณหนึ่งเพื่อเข้าไปเล่นได้ แค่เพียงเราจะใช้เงินน้อยมากกว่าการไปเล่นถึงบ่อนต่างชาติ เพราะด้วยระบบออนไลน์ที่ย้ำการเข้าถึงคนทุกชนชั้น ไมม่ว่าเราจะมีเงินแค่เพียงบาทเดียว เราก็สามารถเล่น

พวกเราเป็นสล็อตเว็บตรงไม่ผ่านเอเย่นต์ ได้รับการรับรองจากบริษัทแม่อย่าง PG ที่เป็นบริษัทชั้นหนึ่งสุดยอด คุณจะได้รับความปลอดภัยสำหรับในการเล่นสล็อตออนไลน์กับเราอย่างไม่ต้องสงสัย ด้วยระบบหน้าเว็บไซต์ที่ดียอด ใช้งานก้าวหน้าแบบไม่มีสะดุด ระบบฝากถอนออโต้ที่ทำรายการได้ง่ายๆด้วยตัวเอง ไม่เป็นอันตรายรวมทั้งรวดเร็วทันใจแบบสุดๆเกมสล็อตออนไลน์จากค่าย PG ทางเข้าpg ก็จัดเต็มแบบสุดๆแล้วอย่างงี้จะไม่เล่นได้อย่างไรล่ะนะครับจริงไหม!

พวกเราเป็นสล็อตเว็บตรงไม่ผ่านเอเย่นต์ ได้รับการรับรองจากบริษัทแม่อย่าง PG ที่เป็นบริษัทชั้นหนึ่งสุดยอด คุณจะได้รับความปลอดภัยสำหรับในการเล่นสล็อตออนไลน์กับเราอย่างไม่ต้องสงสัย ด้วยระบบหน้าเว็บไซต์ที่ดียอด ใช้งานก้าวหน้าแบบไม่มีสะดุด ระบบฝากถอนออโต้ที่ทำรายการได้ง่ายๆด้วยตัวเอง ไม่เป็นอันตรายรวมทั้งรวดเร็วทันใจแบบสุดๆเกมสล็อตออนไลน์จากค่าย PG ทางเข้าpg ก็จัดเต็มแบบสุดๆแล้วอย่างงี้จะไม่เล่นได้อย่างไรล่ะนะครับจริงไหม!

การเลือกเว็บไซต์หนังโป้หนังผู้ใหญ่69 หรือเลือกหนังอาร์ดูราวกับว่ากับการเลือกคบคน ยิ่งเจอกันง่ายก็ยิ่งต้องเลือกให้ดี ถ้าหากอยากได้เขามาเป็นคู่ครองคนก็จำเป็นต้องพิจารณาจากเหตุหลายๆอย่าง ไม่ใช่แค่รูปลักษณ์ภายนอกหรือการพูดคุยแค่ไม่จำนวนกี่ครั้ง เป็นต้นว่า การยอมรับในสิ่งที่ท่านเป็น พวกเราจะเข้าดวงใจในตัวตนที่ของท่านนั้นเป็นและไม่เพียรพยายามแปลงท่าน แต่ว่าพวกเราชอบทำให้ท่านรู้สึกว่าเรารับในสิ่งที่ท่านเป็นไปได้ และทำให้คุณนั้นคิดว่าเวลาที่ท่านได้ดูหนังx เว็บไซต์ jubyet69ดูหนังx ของเราแล้วจะก่อให้ท่านมีความสุขแบบไม่ต้องมาร้องขอเลยล่ะค่ะ

การเลือกเว็บไซต์หนังโป้หนังผู้ใหญ่69 หรือเลือกหนังอาร์ดูราวกับว่ากับการเลือกคบคน ยิ่งเจอกันง่ายก็ยิ่งต้องเลือกให้ดี ถ้าหากอยากได้เขามาเป็นคู่ครองคนก็จำเป็นต้องพิจารณาจากเหตุหลายๆอย่าง ไม่ใช่แค่รูปลักษณ์ภายนอกหรือการพูดคุยแค่ไม่จำนวนกี่ครั้ง เป็นต้นว่า การยอมรับในสิ่งที่ท่านเป็น พวกเราจะเข้าดวงใจในตัวตนที่ของท่านนั้นเป็นและไม่เพียรพยายามแปลงท่าน แต่ว่าพวกเราชอบทำให้ท่านรู้สึกว่าเรารับในสิ่งที่ท่านเป็นไปได้ และทำให้คุณนั้นคิดว่าเวลาที่ท่านได้ดูหนังx เว็บไซต์ jubyet69ดูหนังx ของเราแล้วจะก่อให้ท่านมีความสุขแบบไม่ต้องมาร้องขอเลยล่ะค่ะ ทางเข้าหนังออนไลน์ หนังโป๊69 https://www.Jubyet69.com 6 พ.ค. 2023 Celesta หนังออนไลน์ หนัง 18 ฟรีเว็บไหนดี Top 26

ทางเข้าหนังออนไลน์ หนังโป๊69 https://www.Jubyet69.com 6 พ.ค. 2023 Celesta หนังออนไลน์ หนัง 18 ฟรีเว็บไหนดี Top 26

แนวทางเล่นสล็อตคราวแรก เล่นแบบไหนให้โบนัสแตก แบบไม่ต้องขอคืนดีดวง วันนี้ เว็บมาแรง ที่พร้อมด้วยคุณภาพpg slot เว็บตรง จะพาคุณไปสำรวจขั้นตอนการเล่นฉบับมือใหม่ เป็นเทคนิคการเล่นที่เข้าใจง่าย ทำเงินได้จริง คุณจะบันเทิงใจกับการเดิมพันได้ไม่ติด ไม่ว่าจะเล่นผ่านเครื่องไม้เครื่องมือไหน เราพร้อมจ่ายรางวัลเต็มไม่หัก ไม่มีการล็อคผลชนะ PGSLOT เว็บพนันครบวงจร พร้อมเปิดให้เข้ามาบันเทิงใจกับการเดิมพันผ่านมือถือ สัมผัสความครบครันของบริการ ที่จะเปลี่ยนแปลงให้คุณเป็นลูกค้า VIP เข้าถึงเกมสล็อตสุดพรีเมี่ยวได้ทุกวัน

แนวทางเล่นสล็อตคราวแรก เล่นแบบไหนให้โบนัสแตก แบบไม่ต้องขอคืนดีดวง วันนี้ เว็บมาแรง ที่พร้อมด้วยคุณภาพpg slot เว็บตรง จะพาคุณไปสำรวจขั้นตอนการเล่นฉบับมือใหม่ เป็นเทคนิคการเล่นที่เข้าใจง่าย ทำเงินได้จริง คุณจะบันเทิงใจกับการเดิมพันได้ไม่ติด ไม่ว่าจะเล่นผ่านเครื่องไม้เครื่องมือไหน เราพร้อมจ่ายรางวัลเต็มไม่หัก ไม่มีการล็อคผลชนะ PGSLOT เว็บพนันครบวงจร พร้อมเปิดให้เข้ามาบันเทิงใจกับการเดิมพันผ่านมือถือ สัมผัสความครบครันของบริการ ที่จะเปลี่ยนแปลงให้คุณเป็นลูกค้า VIP เข้าถึงเกมสล็อตสุดพรีเมี่ยวได้ทุกวัน วิธีเล่นสล็อตคราวแรก ทราบก่อน ร่ำรวยก่อน ไม่ต้องง้อดวง

วิธีเล่นสล็อตคราวแรก ทราบก่อน ร่ำรวยก่อน ไม่ต้องง้อดวง

เว็บไซต์สล็อตออนไลน์รับรอง

เว็บไซต์สล็อตออนไลน์รับรอง เว็บตรง slot หาเว็บสล็อต Jinda44.com 8 March 23 Sabine คาสิโน เกมสล็อตมือถือเว็บไหนดี Top 59

เว็บตรง slot หาเว็บสล็อต Jinda44.com 8 March 23 Sabine คาสิโน เกมสล็อตมือถือเว็บไหนดี Top 59

Jubyet69 เว็บไซต์ ดูหนังx ออนไลน์ สูงที่สุดในทวีปเอเชีย หนัง69 เก็บรวบรวมเหล่าดาราตัวท็อปไว้ทั้งสิ้น มีทุกแบบ ไม่ว่าจะเป็น หนังหนังโป้หนังผู้ใหญ่69 หนัง69 หนัง 18 ฟรี บอกเลยว่าของจริงจัดๆJubyet69 สำหรับทุกเพศทุกวัย หนังอาร์69 ก็มีให้ได้ลองตำกันแบบนับไม่ถ้วน ทั้ง ดูหนังx เด็กนักเรียน หนัง69 นักศึกษา หนังเอ็กซ์69 บริษัทหาคู่ รวมถึงงาน onlyfans หนัง 18 ฟรี บอกเลยว่า หนังเอวี69 หนัง69 ของดี หนัง 18 ฟรี อย่างงี้ Jubyet69 ดูพอดีนี่ที่เดียว แถมอัพเดททุกวี่ทุกวันเกือบจะทุกเมื่อ ของใหม่มาใหม่ Jubyet69 จัดให้หมด แตกแล้วแตกอีก แตกจนถึงปวดมือปวดแขนกันไปหมดแล้ววว

Jubyet69 เว็บไซต์ ดูหนังx ออนไลน์ สูงที่สุดในทวีปเอเชีย หนัง69 เก็บรวบรวมเหล่าดาราตัวท็อปไว้ทั้งสิ้น มีทุกแบบ ไม่ว่าจะเป็น หนังหนังโป้หนังผู้ใหญ่69 หนัง69 หนัง 18 ฟรี บอกเลยว่าของจริงจัดๆJubyet69 สำหรับทุกเพศทุกวัย หนังอาร์69 ก็มีให้ได้ลองตำกันแบบนับไม่ถ้วน ทั้ง ดูหนังx เด็กนักเรียน หนัง69 นักศึกษา หนังเอ็กซ์69 บริษัทหาคู่ รวมถึงงาน onlyfans หนัง 18 ฟรี บอกเลยว่า หนังเอวี69 หนัง69 ของดี หนัง 18 ฟรี อย่างงี้ Jubyet69 ดูพอดีนี่ที่เดียว แถมอัพเดททุกวี่ทุกวันเกือบจะทุกเมื่อ ของใหม่มาใหม่ Jubyet69 จัดให้หมด แตกแล้วแตกอีก แตกจนถึงปวดมือปวดแขนกันไปหมดแล้ววว

ขอขอบพระคุณเว็บ

ขอขอบพระคุณเว็บ

pg slot ใหม่ล่าสุดเครดิตฟรี pg slot https://www.Pgslot-1st.com 16 Apr 23 Teodoro No.1 สล็อตเว็บตรงเกมใหม่เพียบ Top 17

pg slot ใหม่ล่าสุดเครดิตฟรี pg slot https://www.Pgslot-1st.com 16 Apr 23 Teodoro No.1 สล็อตเว็บตรงเกมใหม่เพียบ Top 17 ขอขอบคุณที่มา

ขอขอบคุณที่มา

movie2k

movie2k

pgslot

pgslot  ขอขอบพระคุณที่มา

ขอขอบพระคุณที่มา

joker123.money สล็อตเว็บตรงน้องใหม่มาแรง สล็อตเว็บตรงแท้ 100% ลองเลย!

joker123.money สล็อตเว็บตรงน้องใหม่มาแรง สล็อตเว็บตรงแท้ 100% ลองเลย!

สล็อตpgแท้เกมสล็อตออนไลน์ pg slot เทคนิคที่ทุกคนจะต้องทดลองดู

สล็อตpgแท้เกมสล็อตออนไลน์ pg slot เทคนิคที่ทุกคนจะต้องทดลองดู 1. เลือกเล่นเกมสล็อตออนไลน์ที่ดีเยี่ยมที่สุด สล็อตpgแท้

1. เลือกเล่นเกมสล็อตออนไลน์ที่ดีเยี่ยมที่สุด สล็อตpgแท้

สวัสดีครับผมชาว

สวัสดีครับผมชาว

สำหรับคนชอบดูหนังที่ถูกใจดูหนังดังบน Netflix ทางเว็บไซต์หนังออนไลน์ของเราก็อัพเดทมาให้แก่คุณได้ดูหนังออนไลน์อย่างเร็ว ท่านไม่จำเป็นต้องเสียค่าสมัครสมาชิกรายเดือนอีกต่อไป ทางเว็บไซต์ของพวกเรานำหนังใหม่ชนโรง แล้วก็หนังตามที่มีคุณภาพมาให้ทุกคนได้รับดูกัน กล่าวได้ว่าไม่แพ้หนังบนเน็ตฟริกซ์อย่างยิ่งจริงๆ และก็ที่สำคัญเรามีหนังให้เลือกรับดูมากยิ่งกว่าไม่ว่าจะในกระแส หรือนอกกระแส เชื่อว่าทุกคนจะได้รับความสนุกแบบเต็มที่ ครบทุกอรรถรส การเลือก

สำหรับคนชอบดูหนังที่ถูกใจดูหนังดังบน Netflix ทางเว็บไซต์หนังออนไลน์ของเราก็อัพเดทมาให้แก่คุณได้ดูหนังออนไลน์อย่างเร็ว ท่านไม่จำเป็นต้องเสียค่าสมัครสมาชิกรายเดือนอีกต่อไป ทางเว็บไซต์ของพวกเรานำหนังใหม่ชนโรง แล้วก็หนังตามที่มีคุณภาพมาให้ทุกคนได้รับดูกัน กล่าวได้ว่าไม่แพ้หนังบนเน็ตฟริกซ์อย่างยิ่งจริงๆ และก็ที่สำคัญเรามีหนังให้เลือกรับดูมากยิ่งกว่าไม่ว่าจะในกระแส หรือนอกกระแส เชื่อว่าทุกคนจะได้รับความสนุกแบบเต็มที่ ครบทุกอรรถรส การเลือก

ผลดีจากการ ทดสอบเล่นpg มีมากมายจนถึงนับไม่ถ้วน แต่ว่าวันนี้จะมาบอกเหตุผลซักหน่อยว่า ทำไมทุกคนควรจะ ทดลองเล่นสล็อต pg ก่อนที่จะเข้าไปเล่นในเกมของจริงแบบใช้เงินจริง มา!

ผลดีจากการ ทดสอบเล่นpg มีมากมายจนถึงนับไม่ถ้วน แต่ว่าวันนี้จะมาบอกเหตุผลซักหน่อยว่า ทำไมทุกคนควรจะ ทดลองเล่นสล็อต pg ก่อนที่จะเข้าไปเล่นในเกมของจริงแบบใช้เงินจริง มา!

เว็บไซต์สล็อตเว็บตรงสมาชิกใหม่ไฟแรง แฟน pg slot ไม่ควรพลาด!

เว็บไซต์สล็อตเว็บตรงสมาชิกใหม่ไฟแรง แฟน pg slot ไม่ควรพลาด! • โปรโมชั่นโปรเดียวก็เสียวได้ เพียงแค่คุณฝากเงิน 299 ก็มารับไปเลย โบนัสเครดิตฟรี 1,000 บาท (จะต้องฝาก 299 บาทแค่นั้น) แม้กระนั้นคุณต้องทำยอดให้ได้ 5,000 บาท ถึงจะสามารถถอนได้ 1,000 บาท เรียกว่าคุ้มแสนคุ้ม ยอมรับได้สัปดาห์ละ 1 ครั้งเท่านั้น

• โปรโมชั่นโปรเดียวก็เสียวได้ เพียงแค่คุณฝากเงิน 299 ก็มารับไปเลย โบนัสเครดิตฟรี 1,000 บาท (จะต้องฝาก 299 บาทแค่นั้น) แม้กระนั้นคุณต้องทำยอดให้ได้ 5,000 บาท ถึงจะสามารถถอนได้ 1,000 บาท เรียกว่าคุ้มแสนคุ้ม ยอมรับได้สัปดาห์ละ 1 ครั้งเท่านั้น • โปรโมชั่นสายทุนน้อยมาทางนี้ บอกเลยว่า สายทุนน้อยถูกอกถูกใจสิ่งนี้แน่นอน กับโปรโมชั่นจาก สล็อต pg เว็บไซต์ตรง แตกหนักของเรา ซึ่งก็มีหลากหลายโปรโมชั่นให้ท่านเลือกด้วย แต่ละโปรโมชั่นเล่นได้เฉพาะเกมสล็อตที่ไม่มีการซื้อฟรีสปินเพียงแค่นั้น รวมทั้งทุกโปรโมชั่นยอมรับได้วันละ 1 ครั้งแค่นั้น ดังต่อไปนี้นะครับ

• โปรโมชั่นสายทุนน้อยมาทางนี้ บอกเลยว่า สายทุนน้อยถูกอกถูกใจสิ่งนี้แน่นอน กับโปรโมชั่นจาก สล็อต pg เว็บไซต์ตรง แตกหนักของเรา ซึ่งก็มีหลากหลายโปรโมชั่นให้ท่านเลือกด้วย แต่ละโปรโมชั่นเล่นได้เฉพาะเกมสล็อตที่ไม่มีการซื้อฟรีสปินเพียงแค่นั้น รวมทั้งทุกโปรโมชั่นยอมรับได้วันละ 1 ครั้งแค่นั้น ดังต่อไปนี้นะครับ

ปากทางเข้า pg เกมสล็อตเล่นง่าย ทางเข้า pg

ปากทางเข้า pg เกมสล็อตเล่นง่าย ทางเข้า pg pg slot

pg slot

ทำไมจำต้องทดสอบเล่นสล็อต pg สล็อตลักษณะนี้มีดีอะไร?

ทำไมจำต้องทดสอบเล่นสล็อต pg สล็อตลักษณะนี้มีดีอะไร? แทงหวยสด มือใหม่ก็แทงได้ร่ำรวยจริง game.no1huay

แทงหวยสด มือใหม่ก็แทงได้ร่ำรวยจริง game.no1huay  ทำไมนักแทงหวย เว็บหวยสด ถึงถูกใจไปแทงหวยกับเว็บไซต์ลอตเตอรี่ออนไลน์ ด้วยเหตุว่าเว็บสลากกินแบ่งออนไลน์เว็บนี้มิได้ให้บริการเพียงแค่สลากกินแบ่งในประเทศเพียงแค่นั้น แต่ยังให้บริการสลากกินแบ่งเมืองนอกอีกเยอะมาก ไม่ว่าจะเป็นสลากกินแบ่งลาว ลอตเตอรี่เวียดนาม ลอตเตอรี่มาเลย์ หรือแม้แต่หวยหุ้นทางเว็บไซต์ลอตเตอรี่ออนไลน์ของเรายังมีให้บริการ แล้วก็นักการพนันสามารถเลือกเล่นได้ตามความปรารถนา ก็เลยทำให้นักพนันสนใจและเข้ามาใช้บริการแทงหวยออนไลน์กับเว็บไซต์แห่งนี้กันมากขึ้นเรื่อยๆ

ทำไมนักแทงหวย เว็บหวยสด ถึงถูกใจไปแทงหวยกับเว็บไซต์ลอตเตอรี่ออนไลน์ ด้วยเหตุว่าเว็บสลากกินแบ่งออนไลน์เว็บนี้มิได้ให้บริการเพียงแค่สลากกินแบ่งในประเทศเพียงแค่นั้น แต่ยังให้บริการสลากกินแบ่งเมืองนอกอีกเยอะมาก ไม่ว่าจะเป็นสลากกินแบ่งลาว ลอตเตอรี่เวียดนาม ลอตเตอรี่มาเลย์ หรือแม้แต่หวยหุ้นทางเว็บไซต์ลอตเตอรี่ออนไลน์ของเรายังมีให้บริการ แล้วก็นักการพนันสามารถเลือกเล่นได้ตามความปรารถนา ก็เลยทำให้นักพนันสนใจและเข้ามาใช้บริการแทงหวยออนไลน์กับเว็บไซต์แห่งนี้กันมากขึ้นเรื่อยๆ

movieskub ดูหนัง 2023 บริการดูหนังผ่านอินเตอร์เน็ตที่ดีเยี่ยมที่สุด

movieskub ดูหนัง 2023 บริการดูหนังผ่านอินเตอร์เน็ตที่ดีเยี่ยมที่สุด

สล็อตพีจี

สล็อตพีจี  การเล่นสล็อตให้แตกหนักแตกจริงนั้น มีความน่าจะเป็นหลากหลายต้นแบบ ไม่ว่าจะเป็นทุนของทุกท่าน หรือจะเป็นวิธีการเล่นต่างๆแม้กระนั้นสิ่งที่จำเป็นที่สุดที่ทุกคนบางครั้งก็อาจจะไม่เคยระลึกถึง ซึ่งก็คือ การเลือกสถานที่ลงทุนให้เหมาะสม แล้วเงินทุนของทุกท่านจะสดใสร่าเริง สล็อตพีจี ของ Casinoruby88 pgslot นั้น มีความน่าจะเป็นไปได้สูงที่จะแตกแล้วก็แจกตังให้แบบเข้มๆในทุกที่ที่ต้องการ เปรียบได้เสมือนดั่งว่า การเดิมพันสล็อตก็คือการลงทุนอย่างหนึ่ง พวกเราคงจะไม่เลือกไปลงทุนกับบริษัทปลอมที่เป็นบริษัทดุร้ายหนีกฎหมายเข้ามาเปิดหรอกจริงไหม? ด้วยเหตุดังกล่าว สิ่งที่สำคัญที่สุดสำหรับเพื่อการเล่นสล็อตออนไลน์ มันก็คือ การเลือกเว็บที่ถูกต้องในการเล่น เราจะต้องดูจากหลายสาเหตุ ได้แก่ License ลิขสิทธิ์ของเว็บไซต์นั้นๆหรือใบยืนยันความปลอดภัยอย่าง Certificate ที่ สล็อตเว็บตรง เท่านั้นที่จะได้รับ เนื่องจากว่าการที่จะเป็นสล็อตเว็บตรงได้นั้น มันมีขั้นตอนที่นานัปการเยอะแยะ และใช้เงินทุนสูงปรี๊ด ทำให้สล็อตเว็บไซต์ตรง นั้นหายากมากมาย ยิ่งเป็นในประเทศไทยแล้วยิ่งหาย

การเล่นสล็อตให้แตกหนักแตกจริงนั้น มีความน่าจะเป็นหลากหลายต้นแบบ ไม่ว่าจะเป็นทุนของทุกท่าน หรือจะเป็นวิธีการเล่นต่างๆแม้กระนั้นสิ่งที่จำเป็นที่สุดที่ทุกคนบางครั้งก็อาจจะไม่เคยระลึกถึง ซึ่งก็คือ การเลือกสถานที่ลงทุนให้เหมาะสม แล้วเงินทุนของทุกท่านจะสดใสร่าเริง สล็อตพีจี ของ Casinoruby88 pgslot นั้น มีความน่าจะเป็นไปได้สูงที่จะแตกแล้วก็แจกตังให้แบบเข้มๆในทุกที่ที่ต้องการ เปรียบได้เสมือนดั่งว่า การเดิมพันสล็อตก็คือการลงทุนอย่างหนึ่ง พวกเราคงจะไม่เลือกไปลงทุนกับบริษัทปลอมที่เป็นบริษัทดุร้ายหนีกฎหมายเข้ามาเปิดหรอกจริงไหม? ด้วยเหตุดังกล่าว สิ่งที่สำคัญที่สุดสำหรับเพื่อการเล่นสล็อตออนไลน์ มันก็คือ การเลือกเว็บที่ถูกต้องในการเล่น เราจะต้องดูจากหลายสาเหตุ ได้แก่ License ลิขสิทธิ์ของเว็บไซต์นั้นๆหรือใบยืนยันความปลอดภัยอย่าง Certificate ที่ สล็อตเว็บตรง เท่านั้นที่จะได้รับ เนื่องจากว่าการที่จะเป็นสล็อตเว็บตรงได้นั้น มันมีขั้นตอนที่นานัปการเยอะแยะ และใช้เงินทุนสูงปรี๊ด ทำให้สล็อตเว็บไซต์ตรง นั้นหายากมากมาย ยิ่งเป็นในประเทศไทยแล้วยิ่งหาย

การที่เราเคลมตนเองว่าเป็นเว็บไซต์ ดูหนังผ่านอินเตอร์เน็ต หนังใหม่ ดูหนังออนไลน์ 2023 ที่ดีเยี่ยมที่สุดในปีนี้ มันก็ไม่แปลก เพราะว่านอกเหนือจากระบบหน้าเว็บไซต์ของเราจะสะดวกและก็ได้มาตรฐานสากลมากๆแล้ว พวกเรายังมีการจัดการระบบการดูหนังให้ทุกคนได้ดูหนังที่อยากดูฟรีๆดูหนังผ่านอินเตอร์เน็ต หนังใหม่ ดูหนังผ่านอินเตอร์เน็ต 2023 กับเรา ทุกคนจะราวกับได้ดูหนังในแพลทฟอร์มมีชื่อจำนวนมาก ไม่ว่าจะเป็น Netflix Disney hotstar แล้วก็อื่นๆเพราะพวกเรา เว็บ ดูหนังผ่านอินเตอร์เน็ต หนังใหม่ ดูหนังผ่านเน็ต 2023 Movie2k อยากให้ทุกท่านได้ดูหนังผ่านอินเตอร์เน็ตกันอย่างจุใจและคุ้มค่าที่จะดูที่สุด รวมทั้งทั้งผองที่บอกมา มันคือของจริง ภาพคม ชัด ลึก เสียงเป๊ะ full HD ทุกเรื่องทุกตอน แถมเว็บไซต์ ดูหนังผ่านเน็ต หนังใหม่ ดูหนังผ่านเน็ต 2023 ชองเรา ยังอัพเดทหนังไวมากที่สุดในประเทศไทยอย่างไม่ต้องสงสัย เพราะเหตุว่าเราจัดหนักจัดเต็มอีกทั้งหนังโรง หนังชนโรงเราก็มี ครั้งคราวมีหนังที่ยังไม่เข้าโรงที่ประเทศไทยด้วย สุดจัดสุดจริง ดูหนังผ่านเน็ต หนังใหม่ ดูหนังออนไลน์ 2023 กับพวกเรา movie2k จะทำให้ทุกท่าน ได้อัพเดทหนังก่อนคนไหนกัน ไม่ต้องมานั่ละโมบลัวโดนสปอย เพราะพวกเรา movie2k มีหนังให้ทุกคนได้มองกันฟรีๆก่อนคนไหนกันแน่ ดูหนังออนไลน์ หนังใหม่ ดูหนังออนไลน์ 2023 จะต้องนึกถึงพวกเรา movie2k! หนังใหม่

การที่เราเคลมตนเองว่าเป็นเว็บไซต์ ดูหนังผ่านอินเตอร์เน็ต หนังใหม่ ดูหนังออนไลน์ 2023 ที่ดีเยี่ยมที่สุดในปีนี้ มันก็ไม่แปลก เพราะว่านอกเหนือจากระบบหน้าเว็บไซต์ของเราจะสะดวกและก็ได้มาตรฐานสากลมากๆแล้ว พวกเรายังมีการจัดการระบบการดูหนังให้ทุกคนได้ดูหนังที่อยากดูฟรีๆดูหนังผ่านอินเตอร์เน็ต หนังใหม่ ดูหนังผ่านอินเตอร์เน็ต 2023 กับเรา ทุกคนจะราวกับได้ดูหนังในแพลทฟอร์มมีชื่อจำนวนมาก ไม่ว่าจะเป็น Netflix Disney hotstar แล้วก็อื่นๆเพราะพวกเรา เว็บ ดูหนังผ่านอินเตอร์เน็ต หนังใหม่ ดูหนังผ่านเน็ต 2023 Movie2k อยากให้ทุกท่านได้ดูหนังผ่านอินเตอร์เน็ตกันอย่างจุใจและคุ้มค่าที่จะดูที่สุด รวมทั้งทั้งผองที่บอกมา มันคือของจริง ภาพคม ชัด ลึก เสียงเป๊ะ full HD ทุกเรื่องทุกตอน แถมเว็บไซต์ ดูหนังผ่านเน็ต หนังใหม่ ดูหนังผ่านเน็ต 2023 ชองเรา ยังอัพเดทหนังไวมากที่สุดในประเทศไทยอย่างไม่ต้องสงสัย เพราะเหตุว่าเราจัดหนักจัดเต็มอีกทั้งหนังโรง หนังชนโรงเราก็มี ครั้งคราวมีหนังที่ยังไม่เข้าโรงที่ประเทศไทยด้วย สุดจัดสุดจริง ดูหนังผ่านเน็ต หนังใหม่ ดูหนังออนไลน์ 2023 กับพวกเรา movie2k จะทำให้ทุกท่าน ได้อัพเดทหนังก่อนคนไหนกัน ไม่ต้องมานั่ละโมบลัวโดนสปอย เพราะพวกเรา movie2k มีหนังให้ทุกคนได้มองกันฟรีๆก่อนคนไหนกันแน่ ดูหนังออนไลน์ หนังใหม่ ดูหนังออนไลน์ 2023 จะต้องนึกถึงพวกเรา movie2k! หนังใหม่ ถ้าทุกคนเคยมีความคิดว่า ดูหนังผ่านอินเตอร์เน็ต หนังใหม่ ดูหนังออนไลน์ 2023 ดูที่แหน่งใดก็เหมือนกัน คุณกำลังคิดผิดอย่างร้ายแรง มาดูกันเลยดีกว่าว่ามันเว็บไซต์ ดูหนังผ่านอินเตอร์เน็ต หนังใหม่ ดูหนังผ่านเน็ต 2023 มันแตกต่างกันยังไงบ้าง?

ถ้าทุกคนเคยมีความคิดว่า ดูหนังผ่านอินเตอร์เน็ต หนังใหม่ ดูหนังออนไลน์ 2023 ดูที่แหน่งใดก็เหมือนกัน คุณกำลังคิดผิดอย่างร้ายแรง มาดูกันเลยดีกว่าว่ามันเว็บไซต์ ดูหนังผ่านอินเตอร์เน็ต หนังใหม่ ดูหนังผ่านเน็ต 2023 มันแตกต่างกันยังไงบ้าง?

เว็บ สล็อต แจกทุน ฟรี 2022 เข้าทุกวี่วัน มั่งมีทุกวี่ทุกวัน

เว็บ สล็อต แจกทุน ฟรี 2022 เข้าทุกวี่วัน มั่งมีทุกวี่ทุกวัน PGSLOT นอกเหนือจากที่จะลือชื่อเรื่องการให้บริการที่ครอบคลุมมากที่สุด เว็บไซต์แห่งนี้ยังเป็นเว็บไซต์สล็อตคนทุนน้อย ที่เล่นด้วย ทุนหลักร้อยถอนหลักหมื่น ฝาก100รับ100ถอนไม่ยั้ง เราจัดเตรียมเกมแตกง่าย ให้เลือกเล่นมากกว่าคนไหนกันแน่ในปฐพี เล่นง่าย กำไรดี ไม่จำเป็นต้องกลุ้มใจเรื่องทุน รับรองไม่ว่าคุณจะเลือกเล่นเกมไหน ก็มีผลกำไรเข้ากระเป๋ากลับบ้านทุกวัน เนื่องจากทีมงานเราคัดสรรเกมที่เหมาะสมที่สุด มาให้ท่านรับความเพลิดเพลินเเบบไร้ความตึงเครียดเป็นระเบียบเรียบร้อยเเล้ว pg slot เว็บตรง

PGSLOT นอกเหนือจากที่จะลือชื่อเรื่องการให้บริการที่ครอบคลุมมากที่สุด เว็บไซต์แห่งนี้ยังเป็นเว็บไซต์สล็อตคนทุนน้อย ที่เล่นด้วย ทุนหลักร้อยถอนหลักหมื่น ฝาก100รับ100ถอนไม่ยั้ง เราจัดเตรียมเกมแตกง่าย ให้เลือกเล่นมากกว่าคนไหนกันแน่ในปฐพี เล่นง่าย กำไรดี ไม่จำเป็นต้องกลุ้มใจเรื่องทุน รับรองไม่ว่าคุณจะเลือกเล่นเกมไหน ก็มีผลกำไรเข้ากระเป๋ากลับบ้านทุกวัน เนื่องจากทีมงานเราคัดสรรเกมที่เหมาะสมที่สุด มาให้ท่านรับความเพลิดเพลินเเบบไร้ความตึงเครียดเป็นระเบียบเรียบร้อยเเล้ว pg slot เว็บตรง เดิมพันสล็อตออนไลน์ฝากถอนไม่มีอย่างน้อย เริ่ม 1 บาทก็รวยได้

เดิมพันสล็อตออนไลน์ฝากถอนไม่มีอย่างน้อย เริ่ม 1 บาทก็รวยได้ ความน่าดึงดูดใจของการสมัครใช้บริการกับเว็บไซต์สล็อตออนไลน์ มาตรฐานระดับสากล

ความน่าดึงดูดใจของการสมัครใช้บริการกับเว็บไซต์สล็อตออนไลน์ มาตรฐานระดับสากล

เว็บไซต์หนังโป้หนังผู้ใหญ่ jubyet69

เว็บไซต์หนังโป้หนังผู้ใหญ่ jubyet69

m.jinda55 สล็อตเว็บตรง เว็บตรง มั่นคง ปลอดภัย 100 มาทดลองลงทะเบียนสมัครสมาชิกแล้วไม่จำเป็นที่จะต้องมาวิตกกังวลอะไรเลย ที่จะเพิ่มช่องทางได้กำไรได้อย่างดีเยี่ยม แล้วอยากเสนอแนะให้ทดลองเข้ามาเล่าเรียนถึงวิถีทางที่มองหาเว็บตรงที่มีความปลอดภัย,

m.jinda55 สล็อตเว็บตรง เว็บตรง มั่นคง ปลอดภัย 100 มาทดลองลงทะเบียนสมัครสมาชิกแล้วไม่จำเป็นที่จะต้องมาวิตกกังวลอะไรเลย ที่จะเพิ่มช่องทางได้กำไรได้อย่างดีเยี่ยม แล้วอยากเสนอแนะให้ทดลองเข้ามาเล่าเรียนถึงวิถีทางที่มองหาเว็บตรงที่มีความปลอดภัย,  m.jinda55 เว็บสล็อต เว็บตรง มั่นคง ปลอดภัย

m.jinda55 เว็บสล็อต เว็บตรง มั่นคง ปลอดภัย เล่นสล็อตเว็บไซต์ตรงได้เงินจริง มือใหม่ ปั๊มเงินได้ไม่ยาก สล็อตเว็บตรง

เล่นสล็อตเว็บไซต์ตรงได้เงินจริง มือใหม่ ปั๊มเงินได้ไม่ยาก สล็อตเว็บตรง

เปิดประสบการณ์ใหม่เล่นสล็อตออนไลน์เว็บใหญ่เว็บตรง

เปิดประสบการณ์ใหม่เล่นสล็อตออนไลน์เว็บใหญ่เว็บตรง  ขอขอบพระคุณเว็บ

ขอขอบพระคุณเว็บ

สำหรับ สาขาวิชาธุรกิจการบิน ราชภัฏ ถือได้ว่าอีกหนึ่งส่วน ที่จะมีการสอนในเรื่องที่เกี่ยวข้องกับการวางแนวทาง การสอนทางด้านอุตสาหกรรม ทางการบิน และรวมไปถึงธุรกิจการบิน ให้กับคนที่สนใจได้มาเรียนรู้ถึงการให้บริการผู้โดยสาร หรือรวมไปถึงการจัดการสัมภาระรวมถึง การวางแผนทางด้านธุรกิจ ระหว่างประเทศไม่ว่าจะเป็น ทั้งส่งออก และก็นำเข้าจากขนส่งทางอากาศอีกด้วย

สำหรับ สาขาวิชาธุรกิจการบิน ราชภัฏ ถือได้ว่าอีกหนึ่งส่วน ที่จะมีการสอนในเรื่องที่เกี่ยวข้องกับการวางแนวทาง การสอนทางด้านอุตสาหกรรม ทางการบิน และรวมไปถึงธุรกิจการบิน ให้กับคนที่สนใจได้มาเรียนรู้ถึงการให้บริการผู้โดยสาร หรือรวมไปถึงการจัดการสัมภาระรวมถึง การวางแผนทางด้านธุรกิจ ระหว่างประเทศไม่ว่าจะเป็น ทั้งส่งออก และก็นำเข้าจากขนส่งทางอากาศอีกด้วย ก็เลยน่าเชื่อถือว่า ที่จะเป็นอะไรที่ค่อนข้างจะมีความยอดเยี่ยม เป็นความสำคัญแล้วก็เป็นจุดเด่นที่ดีไม่น้อย เลยทีเดียว กับการเลือกวิชาสาขานี้ ในด้านการเล่าเรียนของมหาวิทยาลัยราชภัฏ ที่จะช่วยให้เพิ่มทักษะแล้วก็สามารถที่จะจบมามีงาน ทำในธุรกิจการบินได้อย่างไม่ต้องสงสัย

ก็เลยน่าเชื่อถือว่า ที่จะเป็นอะไรที่ค่อนข้างจะมีความยอดเยี่ยม เป็นความสำคัญแล้วก็เป็นจุดเด่นที่ดีไม่น้อย เลยทีเดียว กับการเลือกวิชาสาขานี้ ในด้านการเล่าเรียนของมหาวิทยาลัยราชภัฏ ที่จะช่วยให้เพิ่มทักษะแล้วก็สามารถที่จะจบมามีงาน ทำในธุรกิจการบินได้อย่างไม่ต้องสงสัย.png) สำหรับสาขาวิชาการธุรกิจการบิน ก็เลยเป็นอีกหนึ่งสาขายอดนิยม ที่กำลังทำความพึงพอใจอยู่ด้วย เริ่มแบบการสอนที่เป็น ระดับสากล สอนภาษาอังกฤษที่ดี รวมทั้งมีความยอดเยี่ยม ก็เลยทำให้สามารถตอบปัญหา กับตลาดแรงงานได้ อย่างแน่นอนที่สุด เท่าที่จะเป็นได้อีกด้วย

สำหรับสาขาวิชาการธุรกิจการบิน ก็เลยเป็นอีกหนึ่งสาขายอดนิยม ที่กำลังทำความพึงพอใจอยู่ด้วย เริ่มแบบการสอนที่เป็น ระดับสากล สอนภาษาอังกฤษที่ดี รวมทั้งมีความยอดเยี่ยม ก็เลยทำให้สามารถตอบปัญหา กับตลาดแรงงานได้ อย่างแน่นอนที่สุด เท่าที่จะเป็นได้อีกด้วย สมัครเข้าเรียน เช่นไร?

สมัครเข้าเรียน เช่นไร?

LIVE22 อย่าพลาดกับสล็อตเว็บตรงไม่ผ่านเอเย่นต์ที่เหมาะสมที่สุด เว็บตรงแท้ที่ยอดเยี่ยมในไทย ลงทะเบียนเป็นสมาชิกได้แล้ววันนี้!

LIVE22 อย่าพลาดกับสล็อตเว็บตรงไม่ผ่านเอเย่นต์ที่เหมาะสมที่สุด เว็บตรงแท้ที่ยอดเยี่ยมในไทย ลงทะเบียนเป็นสมาชิกได้แล้ววันนี้! • สล็อตสามารถควบคุมได้ หลายท่านมักคิดกันไปเองว่า สล็อตสามารถตั้งค่าได้ ทำให้เล่นเท่าไรก็เล่นเสีย มันก็จำเป็นต้องย้อนกลับไปที่ระบบ RNG หรือระบบ Random Number Generator

• สล็อตสามารถควบคุมได้ หลายท่านมักคิดกันไปเองว่า สล็อตสามารถตั้งค่าได้ ทำให้เล่นเท่าไรก็เล่นเสีย มันก็จำเป็นต้องย้อนกลับไปที่ระบบ RNG หรือระบบ Random Number Generator

PUNPRO777 สล็อตเว็บไซต์ตรงแท้ ไม่ผ่านเอเย่นต์ เว็บไซต์ตรงแตกง่าย มาตรฐานเว็บตรงสุดยอด สมัครเลย!

PUNPRO777 สล็อตเว็บไซต์ตรงแท้ ไม่ผ่านเอเย่นต์ เว็บไซต์ตรงแตกง่าย มาตรฐานเว็บตรงสุดยอด สมัครเลย!

วิเคราะห์เลขทะเบียนรถอยากขายทะเบียนรถ ทะเบียนสวย Tabiengod.com

วิเคราะห์เลขทะเบียนรถอยากขายทะเบียนรถ ทะเบียนสวย Tabiengod.com  PGSLOT จัดเต็มความเบิกบานใจเต็มแบบอย่าง pg slot หาง่าย สล็อตแจกเครดิตฟรีปังๆ รับรองความแตกง่าย ทดลองเลย!

PGSLOT จัดเต็มความเบิกบานใจเต็มแบบอย่าง pg slot หาง่าย สล็อตแจกเครดิตฟรีปังๆ รับรองความแตกง่าย ทดลองเลย! 3 สิ่งที่คุณจำเป็นต้องดูก่อนเลือกเกมสล็อตออนไลน์สักเกมจากpg

3 สิ่งที่คุณจำเป็นต้องดูก่อนเลือกเกมสล็อตออนไลน์สักเกมจากpg

ขอขอบพระคุณby web

ขอขอบพระคุณby web

• เว็บไซต์ pg ของเรา จะต้องผ่านการคัดสรรจากเว็บสล็อตออนไลน์มากไม่น้อยเลยทีเดียวทั่วทั้งโลกที่สมัครสมาชิกวิเคราะห์คุณสมบัติเว็บ เพื่อจะขึ้นเป็น สล็อตเว็บตรง อย่างแม่นยำ

• เว็บไซต์ pg ของเรา จะต้องผ่านการคัดสรรจากเว็บสล็อตออนไลน์มากไม่น้อยเลยทีเดียวทั่วทั้งโลกที่สมัครสมาชิกวิเคราะห์คุณสมบัติเว็บ เพื่อจะขึ้นเป็น สล็อตเว็บตรง อย่างแม่นยำ 2. อาจวามไม่เป็นอันตรายด้านการบัญชี หรือเรียกอีกอย่างว่า เป็นความไม่มีอันตรายทางด้านการทำธุรกรรมต่างๆเกี่ยวกับเงิน เครดิตแล้วก็ข้อมูลบัญชีธนาคารต่างๆของลูกค้า ทุกๆสิ่งทุกๆอย่างต้องเป็นความลับและไม่มีการล่วงละเมิดสิ่งต่างๆที่สามารถส่งผลให้เกิดการขโมยเงินหรือขโมยบัญชีธนาคาร รวมถึงข้อมูลของบัญชีธนาคาร เรื่องราวธุรกรรมต่างๆระหว่างลูกค้ากับเว็บไซต์ pg ของพวกเรา จะต้องเป็นความลับสูงสุด

2. อาจวามไม่เป็นอันตรายด้านการบัญชี หรือเรียกอีกอย่างว่า เป็นความไม่มีอันตรายทางด้านการทำธุรกรรมต่างๆเกี่ยวกับเงิน เครดิตแล้วก็ข้อมูลบัญชีธนาคารต่างๆของลูกค้า ทุกๆสิ่งทุกๆอย่างต้องเป็นความลับและไม่มีการล่วงละเมิดสิ่งต่างๆที่สามารถส่งผลให้เกิดการขโมยเงินหรือขโมยบัญชีธนาคาร รวมถึงข้อมูลของบัญชีธนาคาร เรื่องราวธุรกรรมต่างๆระหว่างลูกค้ากับเว็บไซต์ pg ของพวกเรา จะต้องเป็นความลับสูงสุด

ชวนดูหนังจากจักรวาล Marvel สะสมไว้ในที่เดียวให้คุณ กับหมวดหมู่ รวมหนังภาคต่อ

ชวนดูหนังจากจักรวาล Marvel สะสมไว้ในที่เดียวให้คุณ กับหมวดหมู่ รวมหนังภาคต่อ 4. หนังบรรยายไทยมีเยอะ แม้คุณเข้าไปในหมวดหมู่บนเว็บไซต์หนังของพวกเรา คุณจะมองเห็นได้ว่า มีหนังรวมทั้งซีรีส์จากต่างแดนมากมายก่ายกอง ซึ่งบอกเลยว่า นอกเหนือจากซับไทยแล้ว พวกเรายังมีหนังบรรยายไทยอีกมากมายด้วยขอรับ เพราะเหตุว่าหลายๆคนบางครั้งก็อาจจะเกลียดชังการอ่านซับ หนังหลายๆเรื่องจึงมีบรรยายไทย ซึ่งพวกเราก็เอามาให้ท่านเลือกรับดูได้เช่นเดียวกัน

4. หนังบรรยายไทยมีเยอะ แม้คุณเข้าไปในหมวดหมู่บนเว็บไซต์หนังของพวกเรา คุณจะมองเห็นได้ว่า มีหนังรวมทั้งซีรีส์จากต่างแดนมากมายก่ายกอง ซึ่งบอกเลยว่า นอกเหนือจากซับไทยแล้ว พวกเรายังมีหนังบรรยายไทยอีกมากมายด้วยขอรับ เพราะเหตุว่าหลายๆคนบางครั้งก็อาจจะเกลียดชังการอ่านซับ หนังหลายๆเรื่องจึงมีบรรยายไทย ซึ่งพวกเราก็เอามาให้ท่านเลือกรับดูได้เช่นเดียวกัน

ตอนผมคิดถึงประเด็นนี้ ผมก็รำลึกถึงสถานะการณ์เมื่อเช้าขณะที่ผมบอกแม่ว่า ผมพึ่งซื้อการ์ตูนเรื่องโปรดไป แม่ผมถามคำถามว่า เพราะเหตุใดโตแล้วยังชอบอ่านการ์ตูน มันก็ไม่ใช่เรื่องผิดหรอกครับ แม้กระนั้นก็แอบตะขิดตะข่วนใจบางส่วนแบบเดียวกัน ฮ่า… ซึ่งการดูหนังออนไลน์การ์ตูนก็น่าจะเจอกับปริศนากลุ่มนี้เช่นเดียวกันนะครับ คนถามก็ไม่ผิดที่สงสัย แต่ผมบอกเลยครับว่า ถึงเราจะโตเท่าไร

ตอนผมคิดถึงประเด็นนี้ ผมก็รำลึกถึงสถานะการณ์เมื่อเช้าขณะที่ผมบอกแม่ว่า ผมพึ่งซื้อการ์ตูนเรื่องโปรดไป แม่ผมถามคำถามว่า เพราะเหตุใดโตแล้วยังชอบอ่านการ์ตูน มันก็ไม่ใช่เรื่องผิดหรอกครับ แม้กระนั้นก็แอบตะขิดตะข่วนใจบางส่วนแบบเดียวกัน ฮ่า… ซึ่งการดูหนังออนไลน์การ์ตูนก็น่าจะเจอกับปริศนากลุ่มนี้เช่นเดียวกันนะครับ คนถามก็ไม่ผิดที่สงสัย แต่ผมบอกเลยครับว่า ถึงเราจะโตเท่าไร ขอขอบคุณมากที่มา

ขอขอบคุณมากที่มา

มาดูหนังออนไลน์กับเว็บดูหนังที่ปี 2024 กันไหมล่ะครับผม กับเรา หนังออนไลน์ ที่จะให้คุณได้บันเทิงใจและก็เพลิดเพลินใจไปกับการดูหนังแบบสุดๆหนังออนไลน์แบบเพลิดเพลินๆดูหนังแบบฟินๆไม่มีอะไรกีดขวาง สามารถมองผ่านเครื่องไม้เครื่องมืออะไรก็ได้ คอมพิวเตอร์ โน้ตบุ๊ก แท็ปเล็ต ไอแพด หรือโทรศัพท์มือถือทั้งระบบ iOS รวมทั้ง Android ก็สามารถมองได้แบบฟินๆอย่าพลาดทุกหนังดี ซีรีส์เด็ด คลิกเลย!

มาดูหนังออนไลน์กับเว็บดูหนังที่ปี 2024 กันไหมล่ะครับผม กับเรา หนังออนไลน์ ที่จะให้คุณได้บันเทิงใจและก็เพลิดเพลินใจไปกับการดูหนังแบบสุดๆหนังออนไลน์แบบเพลิดเพลินๆดูหนังแบบฟินๆไม่มีอะไรกีดขวาง สามารถมองผ่านเครื่องไม้เครื่องมืออะไรก็ได้ คอมพิวเตอร์ โน้ตบุ๊ก แท็ปเล็ต ไอแพด หรือโทรศัพท์มือถือทั้งระบบ iOS รวมทั้ง Android ก็สามารถมองได้แบบฟินๆอย่าพลาดทุกหนังดี ซีรีส์เด็ด คลิกเลย! Pg77 สล็อตเว็บไซต์ตรงแตกง่าย รับรองความแตกง่ายจากค่าย PG สนุกกับเกมสล็อตได้วันแล้ววันเล่า ลองเลย!

Pg77 สล็อตเว็บไซต์ตรงแตกง่าย รับรองความแตกง่ายจากค่าย PG สนุกกับเกมสล็อตได้วันแล้ววันเล่า ลองเลย! เล่นสล็อตออนไลน์กับพวกเรา slot เล่นบนเว็บได้เลยในทันที ไม่ต้องดาวน์โหลดหรือติดตั้ง

เล่นสล็อตออนไลน์กับพวกเรา slot เล่นบนเว็บได้เลยในทันที ไม่ต้องดาวน์โหลดหรือติดตั้ง 1. สล็อตเว็บตรงไม่ผ่านเอเย่นต์

1. สล็อตเว็บตรงไม่ผ่านเอเย่นต์

สล็อต168 คือหนทางที่ดีที่สุด ในด้านการบริการ จัดเต็ม คุณสามารถไปสู่บริการ เจริญ มีคุณภาพที่ยอดเยี่ยม ให้ท่านได้บรรลุความสำเร็จ มากยิ่งกว่า 99% กับการสร้างรายได้ที่ดี ผ่านเว็บไซต์ตรง คุณภาพที่ยอดเยี่ยม สมควรสูง บริการดี เป็นประโยชน์ พร้อมให้บริการที่ดี อย่างเหมาะควร คุ้มกว่าที่คุณคิด และยกระดับ จากการเล่นธรรมดาธรรมดาสู่การลงทุน ที่ไม่เหมือนใคร ยกฐานะสู่ การผลิตรายได้ ที่สุดยอด ในทุกส่วนสำคัญ ในทุกประสิทธิภาพ ในทุกรูปแบบ ในทุกส่วนองค์ประกอบ รวมทั้งบริการที่จัดเต็ม กว่าที่คุณคิด การันตีได้ว่า สิ่งนี้คือ สิ่งที่ยกระดับ จากการเล่นที่สุดยอดสูง กับประสิทธิภาพ ในทุกทาง ที่ไม่เหมือนใคร พร้อมประสบการณ์ใหม่ ในทุกแบบ 168slot.win ตรงนี้ ที่เดียวเท่านั้น

สล็อต168 คือหนทางที่ดีที่สุด ในด้านการบริการ จัดเต็ม คุณสามารถไปสู่บริการ เจริญ มีคุณภาพที่ยอดเยี่ยม ให้ท่านได้บรรลุความสำเร็จ มากยิ่งกว่า 99% กับการสร้างรายได้ที่ดี ผ่านเว็บไซต์ตรง คุณภาพที่ยอดเยี่ยม สมควรสูง บริการดี เป็นประโยชน์ พร้อมให้บริการที่ดี อย่างเหมาะควร คุ้มกว่าที่คุณคิด และยกระดับ จากการเล่นธรรมดาธรรมดาสู่การลงทุน ที่ไม่เหมือนใคร ยกฐานะสู่ การผลิตรายได้ ที่สุดยอด ในทุกส่วนสำคัญ ในทุกประสิทธิภาพ ในทุกรูปแบบ ในทุกส่วนองค์ประกอบ รวมทั้งบริการที่จัดเต็ม กว่าที่คุณคิด การันตีได้ว่า สิ่งนี้คือ สิ่งที่ยกระดับ จากการเล่นที่สุดยอดสูง กับประสิทธิภาพ ในทุกทาง ที่ไม่เหมือนใคร พร้อมประสบการณ์ใหม่ ในทุกแบบ 168slot.win ตรงนี้ ที่เดียวเท่านั้น เชื่อเลยว่าคุ้ม สล็อต168 พร้อมบริการลู่ทางใหม่

เชื่อเลยว่าคุ้ม สล็อต168 พร้อมบริการลู่ทางใหม่

สล็อตเว็บไซต์ตรง เกมพนันที่ใหญ่ที่สุดในศตวรรษอยู่ที่นี่แล้ว temmax69

สล็อตเว็บไซต์ตรง เกมพนันที่ใหญ่ที่สุดในศตวรรษอยู่ที่นี่แล้ว temmax69 นาทีนี้ไม่มีผู้ใดไม่เคยรู้สล็อตเว็บตรงหนึ่งในเกมการเดิมพันยอดนิยมเยอะที่สุด ด้วยเหตุว่าเป็นเกมที่เล่นง่าย ทราบผลไว แถมได้เงินเยอะที่สุดอีกด้วย ถ้าคุณพึงพอใจที่จะร่วมเป็นส่วนหนึ่งส่วนใดของการพนัน พวกเราขอชี้แนะให้ท่านได้รู้จะกับ สล็อตเว็บตรง เว็บไซต์พนันออนไลน์ที่ใหญ่ที่สุดในไทย เราถือได้ว่าเว็บที่นำเข้า pgslot จากต่างแดนมากที่สุด แถมเป็นเว็บที่ขึ้นชื่อเรื่องของเสถียรภาพของระบบที่เร็วแรงหนำใจ เล่นลื่นไหลไม่สะดุด แถมยังพร้อมเรื่องของโปรโมชั่น รวมทั้งบริการอื่นๆข้างในเว็บไซต์อีกด้วย ถ้าหากคุณสนใจที่จะมาร่วมพนันในสล็อตเว็บตรงที่ใหญ่ที่สุดในศตวรรษ สามารถเข้ามาเล่นได้แล้วที่ สล็อต เท่านั้น

นาทีนี้ไม่มีผู้ใดไม่เคยรู้สล็อตเว็บตรงหนึ่งในเกมการเดิมพันยอดนิยมเยอะที่สุด ด้วยเหตุว่าเป็นเกมที่เล่นง่าย ทราบผลไว แถมได้เงินเยอะที่สุดอีกด้วย ถ้าคุณพึงพอใจที่จะร่วมเป็นส่วนหนึ่งส่วนใดของการพนัน พวกเราขอชี้แนะให้ท่านได้รู้จะกับ สล็อตเว็บตรง เว็บไซต์พนันออนไลน์ที่ใหญ่ที่สุดในไทย เราถือได้ว่าเว็บที่นำเข้า pgslot จากต่างแดนมากที่สุด แถมเป็นเว็บที่ขึ้นชื่อเรื่องของเสถียรภาพของระบบที่เร็วแรงหนำใจ เล่นลื่นไหลไม่สะดุด แถมยังพร้อมเรื่องของโปรโมชั่น รวมทั้งบริการอื่นๆข้างในเว็บไซต์อีกด้วย ถ้าหากคุณสนใจที่จะมาร่วมพนันในสล็อตเว็บตรงที่ใหญ่ที่สุดในศตวรรษ สามารถเข้ามาเล่นได้แล้วที่ สล็อต เท่านั้น สล็อตเกมพนันที่เป็นมากกว่าเกมการพนัน

สล็อตเกมพนันที่เป็นมากกว่าเกมการพนัน

แนะนำยอดเยี่ยมเกม 1xbet ชื่อดังที่ปีจากค่าย สล็อต

แนะนำยอดเยี่ยมเกม 1xbet ชื่อดังที่ปีจากค่าย สล็อต • Fortune tiger:

• Fortune tiger:  • Fortune ox: โคโดด สุดยอดเกมตำนานอีกเกม เป็นเกมแนวเดียวกันกับเสือโยนซองอั่งเปาเลยจ๊า ถึงจะมีอัตราการจ่ายที่ถูกกว่าเสือหน่อย แต่ว่าเกมนี้มีไลน์การจ่ายที่มากกว่าเสือหลายไลน์มาก แถมการเข้าฟรีเกม หรือวัวโดดก็มากันรัวๆไม่ได้มีความแตกต่างจากเจ้าเสือเลยคะจะบอกให้ ไม่มีคำว่าธรรมดาในสารบบของเขาจริง 1xbet

• Fortune ox: โคโดด สุดยอดเกมตำนานอีกเกม เป็นเกมแนวเดียวกันกับเสือโยนซองอั่งเปาเลยจ๊า ถึงจะมีอัตราการจ่ายที่ถูกกว่าเสือหน่อย แต่ว่าเกมนี้มีไลน์การจ่ายที่มากกว่าเสือหลายไลน์มาก แถมการเข้าฟรีเกม หรือวัวโดดก็มากันรัวๆไม่ได้มีความแตกต่างจากเจ้าเสือเลยคะจะบอกให้ ไม่มีคำว่าธรรมดาในสารบบของเขาจริง 1xbet

• เป็นเว็บที่มีระบบรักษาความปลอดภัยอย่างครบถ้วน อีกทั้งในด้านของ ข้อมูลส่วนตัว ประวัติความเป็นมาบันทึกวิธีการทำธุรกรรม รวมไปถึงระบบความปลอดภัยของการฝากถอนและเล่นเกมpgslotในเว็บนั้นๆทุกต้นแบบ

• เป็นเว็บที่มีระบบรักษาความปลอดภัยอย่างครบถ้วน อีกทั้งในด้านของ ข้อมูลส่วนตัว ประวัติความเป็นมาบันทึกวิธีการทำธุรกรรม รวมไปถึงระบบความปลอดภัยของการฝากถอนและเล่นเกมpgslotในเว็บนั้นๆทุกต้นแบบ • ระบบหน้าเว็บไซต์จะต้องมีความมีประสิทธิภาพมากพอที่จะให้บริการผู้ใช้อย่างน้อย 5000 ยูซเซอร์พร้อมๆกัน เพราะว่า การที่เว็บไซต์เว็บนึ่งจะได้รับ License ยืนยันการเป็นเว็บไซต์ตรงเว็บไซต์แท้แล้ว รู้ไว้เลยว่าคนเข้าหาเข้ามาเล่นมากขึ้นมากแน่ๆ

• ระบบหน้าเว็บไซต์จะต้องมีความมีประสิทธิภาพมากพอที่จะให้บริการผู้ใช้อย่างน้อย 5000 ยูซเซอร์พร้อมๆกัน เพราะว่า การที่เว็บไซต์เว็บนึ่งจะได้รับ License ยืนยันการเป็นเว็บไซต์ตรงเว็บไซต์แท้แล้ว รู้ไว้เลยว่าคนเข้าหาเข้ามาเล่นมากขึ้นมากแน่ๆ เว็บไซต์

เว็บไซต์  • กดที่รายการอาหาร ฝากเงิน อัตโนมัติ จากนั้น กดใส่จำนวนจำนวนเงินที่ปรารถนาฝากเข้าเว็บไซต์ จากนั้นโอนเงินให้ยอดตรงกับตัวเลขที่ปรารถนาฝาก เช็คชื่อแล้วก็เลขบัญชีให้ตรงกับคนรับ ทำรายการตามขั้นตอนได้เลยคะ

• กดที่รายการอาหาร ฝากเงิน อัตโนมัติ จากนั้น กดใส่จำนวนจำนวนเงินที่ปรารถนาฝากเข้าเว็บไซต์ จากนั้นโอนเงินให้ยอดตรงกับตัวเลขที่ปรารถนาฝาก เช็คชื่อแล้วก็เลขบัญชีให้ตรงกับคนรับ ทำรายการตามขั้นตอนได้เลยคะ ขอขอบคุณเว็ปไซต์

ขอขอบคุณเว็ปไซต์  -เว็บไซต์ของเรานำเข้าเกมslot แท้จากต่างแดนมาโดยเฉพาะอย่างยิ่ง เพื่อได้สนุกมันส์กับสล็อตที่มีคุณภาพสุดยอด แถมยังเต็มที่ไปกับความสนุกจากการล่าแจ็คพ็อตในเกมอีกด้วย

-เว็บไซต์ของเรานำเข้าเกมslot แท้จากต่างแดนมาโดยเฉพาะอย่างยิ่ง เพื่อได้สนุกมันส์กับสล็อตที่มีคุณภาพสุดยอด แถมยังเต็มที่ไปกับความสนุกจากการล่าแจ็คพ็อตในเกมอีกด้วย -เว็บไซต์ของเราเป็นมีเกมพนันอื่นๆให้ท่านได้เลือกเล่นมากมายก่ายกอง เป็นต้นว่า เกมแทงหวย เกมยิงปลา เกมคาสิโน เกมป็อกกระดอน เกมคีโน่ แล้วก็เกมแผนภูมิ ให้ท่านได้เลือกพนันมากไม่น้อยเลยทีเดียว คุณจะได้รับความสนุกสนานร่าเริงจากเกมอื่นๆนอกจากเกมสล็อตอีกด้วย

-เว็บไซต์ของเราเป็นมีเกมพนันอื่นๆให้ท่านได้เลือกเล่นมากมายก่ายกอง เป็นต้นว่า เกมแทงหวย เกมยิงปลา เกมคาสิโน เกมป็อกกระดอน เกมคีโน่ แล้วก็เกมแผนภูมิ ให้ท่านได้เลือกพนันมากไม่น้อยเลยทีเดียว คุณจะได้รับความสนุกสนานร่าเริงจากเกมอื่นๆนอกจากเกมสล็อตอีกด้วย

ทางเข้า PGSLOT หาง่าย ใช้งานได้จริง เพื่อให้คุณเลือกเองได้ตามใจอยาก ลองเลย!

ทางเข้า PGSLOT หาง่าย ใช้งานได้จริง เพื่อให้คุณเลือกเองได้ตามใจอยาก ลองเลย!